Bank of Baroda (BOB) Car Loan Eligibility Calculator

Bank of Baroda offers flexible car loans for new, used, and CNG/LPG vehicles with attractive rates starting at 8.85% p.a. Customers can finance up to 90% of the on-road price and enjoy tenures of up to 7 years. There are no foreclosure charges and special concessions for home loan customers or those offering 50% liquid collateral.

Salaried individuals can avail loans up to ₹2 crore or twice their annual income, while self-employed borrowers can get up to three times their average annual income over the past two years.

Bank of Baroda Car Loan Eligibility

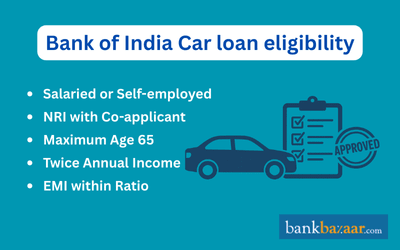

In order to avail of a car loan from Bank of Baroda, you should fit the criteria set out by the bank.

Parameter | Eligibility Details |

Age | Minimum 21 years; maximum 65 years or retirement (whichever is earlier) |

Income | Salaried: Minimum ₹25,000/month; Self-employed: ₹3 lakh p.a. |

Employment / Business Stability | Minimum 2 years (salaried) or 3 years (self-employed) |

Loan Amount | Up to ₹2 crore; 90% of on-road price (new cars) |

Tenure | Up to 84 months (new cars), 36 months (used cars) |

Credit Score | 700+ preferred for quick approval |

Special Benefits | No prepayment penalty; concessions for home loan customers and liquid collateral |

Factors affecting Bank of Baroda Car Loan Eligibility

When you apply for a car loan, a few factors come into play that will affect your eligibility.

Age - Every bank has an age bar within which they will provide you a loan. Bank of Baroda requires you to be at least 21 years old. The bank also needs to be safe with the maximum age limit. They restrict the maximum age for salaried individuals to the retirement age. For business people, it is set at 65 years. By this maximum age limit, you should complete repaying the loan.

Income - Your income will determine how much of a loan you are eligible for. For instance, if you are earning a gross annual income of Rs. 6 lakhs, you can get a car loan from Bank of Baroda of Rs. 12 lakhs. The maximum loan amount is capped at Rs. 1 crore. For business people, the average of the past 2 years’ gross annual income is taken into account, and customers can avail of thrice that income.

Credit Score - Credit scores have become all-important in the banking world today. Before banks can lend you money, they need to know you’re a worthy customer. So banks inquire about your CIBIL score to see what kind of credit consumer you have been in the past. A low score can affect your car loan eligibility because it may lead banks to think that you are not credible.

Prior debt

Debt-to-income ratio is also important when it comes to taking out loans. If you currently have other debt such as credit cards, personal loans, home loans and the like, your debt-to-income ratio will be high. Banks will lend you only so much that they feel you will be able to pay back. Usually the EMIs you have to pay should not exceed 40-50% of your salary.

How does CIBIL scores affect your Bank of Baroda Eligibility?

CIBIL scores are determined by a number of instances that are committed by you when you take out loans. Your credit card spending and repayment patterns, loan repayments, amount of unsecured debt, defaults on payments, late payments are all taken into account. Repaying EMIs on time drives your score up. Paying credit card bills in full also works in favor for a good credit score. On the other hand, defaults and late payments can take away points and result in a lower score. Good scores gives bank’s a good impression of you, and the process of your loan will be smoother, quicker and easier.

How to increase your Bank of Baroda Car loan eligibility?

To secure a Bank of Baroda Car Loan and buy the car you need, you need to meet the eligibility requirements. If you find that you are not eligible or the loan amount is not enough, there are ways to change that.

- Clear off any current debt you might be holding. Try as much as you can to clear credit cards or other loan EMIs. This will drastically improve your debt-to-income ratio.

- If your credit score is low, purchase your score on the CIBIL website and find out the reasons. Try to get them rectified or make changes in your credit patterns to fix it.

- Add your spouse or immediate family’s income to increase your eligibility. They will be a co-borrower of the loan. Your immediate family includes your parents, siblings, and children.

- Offering a higher down payment will also add to your eligibility criteria. The terms and conditions of your loan will also be more favourable.

Car Loan Articles

- Car Prices in India

- How To Transfer a Car Loan to Another Person

- How GST Affected Car Prices in India

- Car Lease Vs Car Loan

- Car Loan Foreclosure Procedure

- Vehicle Registration

- Car Loan Document Checklist

- Bad Credit Car Loan

- Car Loan Refinancing

- Zero Downpayment Car Loan

- Commercial Car Loan

- Car Loan for Nris

- Car Loan Schemes for Women

- Car Loan Preclosure

- Transfer Car Registration

- Top 10 Banks for Car Loan

- Car Loan Schemes for Government Employees

- Fuel Efficient Sedan Cars

- Automatic Cars for Women

- Chepest Cars in India

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.