Loan Approval Process On CIBIL Scores

Availing a loan is not as easy as it was earlier. It is a lengthy and a complicated process for a lot of people. The lenders nowadays refer to a person's CIBIL score to provide the loan. Unless you have a credit history, the lenders may reject the loan application or provide you the loan at a higher interest rate.

Table of Contents

What is Loan Approval Process

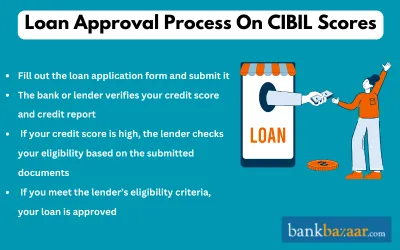

When you apply for the loan, this is what happens:

- You fill in the loan application form.

- You hand it over to the bank or lender.

- Bank or lender checks with CIBIL for credit score and credit report.

- Low credit score leads to rejection of the loan.

- High credit score leads to eligibility check based on the documents you have submitted.

- Non-eligibility leads to rejection of the application.

- On meeting the lenders or banks eligibility criteria, the lender or bank will approve your loan.

79% of the loans that are disbursed are to the individuals who have a Credit score that is greater than 750.

What do the lenders check for in your CIBIL report?

The banks or lenders look for the following in the CIBIL Report:

- If there have been a written off case reported in the Credit Information Report. This information will be available in the Account Status section of your credit report.

- Payment history trend is the other aspect that the lender will look into. They check if they have been any defaults and the overdue amount. This information will be available in the Days Past Due field of the Credit Information Report.

- Company profile is the next section that the lenders look into. The banks usually have an approved list to whom to extend the loan to.

- EMI to income ratio is the next thing the lenders and banks take into account. In case your current EMI exceeds 50% of your monthly salary, the chances of you getting a loan is low.

For example let's take two cases:

Case 1: Income is Rs.50,000 , Total EMI being paid is Rs.10,000, EMI to income ratio is 10000/50000 that is 20%. Your total borrowing capacity is 50% of Rs.50,000 that is Rs.25,000 and the EMI you can afford after the already existing EMI is Rs.25,000- Rs.10,000 that is Rs.15,000. Based on this the additional loan that can be sanctioned to you at an interest rate of 10% for over 20 years is Rs.15,00,000. Then there is a good chance that the bank or the lender will approve your loan.

Case 2: Income is Rs.1,00,000 , Total EMI being paid is Rs.50,000, EMI to income ratio is 50000/100000 that is 50%. Your total borrowing capacity is 50% of Rs.50,000 that is Rs.50,000 and the EMI you can afford after the already existing EMI is Rs.50,000- Rs.50,000 that is Rs.0. Based on this the additional loan that can be sanctioned to you at an interest rate of 10% for over 20 years is Rs.0. Then there is a good chance that the bank or the lender will not approve your loan.

Credit Information Report enables you to apply the following loans:

Personal loan approval process:

You can take a personal loan for any purpose, it could be for your wedding, home renovation, travel, vacation or to make utility and school fee payments. You can take secured or an unsecured loan. It is quick and requires less documentation. Depending on your credit history the lenders provide you an interest rate. You can log on to Xpress Acquire to check the interest rate offered to you by the various banks based on your Credit score and other parameters.

The interest rate depends on the following factors:

- Loan amount compared to your income.

- Loan tenure

- Credit profile which is determined from the Credit Report.

- Repayment history

- Your company profile

The loan may be approved in as little as 24 hours or it might take up to 7 working days based on your credentials. Borrow within your means and make sure you do not miss making any payments. You will also be offered a fixed interest rate or a floating interest rate which might fluctuate with the market.

The lenders require the following documents to process your personal loan application:

- Latest Credit Score and Credit Information Report

- Bank Statement

- KYC documents like identity, signature and address proof

- Income Statement

- Last 3 years IT return for self-employed

Auto Loan approval process:

Auto loan is taken to buy a vehicle and they are usually secured against the vehicle itself. You can take an auto loan to buy a vehicle for personal purpose two wheelers or four wheelers and commercial vehicles. You get up to 90% of the invoice value of the vehicle as a loan. The repayment is based on your income and other requirements. The interest rate depends on the type of the vehicle and the loan amount.

While checking your CIR, the lenders look for:

- Your income

- Credit history

- Current loan repayments

The lender will require the following documents:

- Latest Credit Score and Credit Information Report

- Bank Statement

- KYC documents like identity, signature and address proof

- Income Statement

- Registration papers

Home loan approval process:

Home loan is provided to individuals who want to purchase a property or build a house. The property will be mortgaged to the lender as a collateral. You get loan for home improvement or extension as well. You can also take a loan against your property. Up to 80-85% of the cost of the property is given as a loan. Repayment tenure varies from 5 years to 30 years. Keep in mind that you will be charged a processing or a booking fee, pre-payment penalty will be charged and miscellaneous costs like legal fee will be charged.

Lenders look for:

- Good credit history

- Annual and monthly income

- Existing EMI of the consumer

- Clean title to the house or the property

The following documents will be required for processing your home loan application:

- Latest Credit Score and Credit Information Report

- Bank Statement

- KYC documents like identity, signature and address proof

- Income Statement

- Property papers

- Last three years IT return

So it is advisable to maintain a good credit score. You can do that by paying your dues on time and keeping your balance low and maintaining a good mix or secured and unsecured loan and apply for credit cautiously, monitor your joint accounts and review your credit history frequently throughout the year.

Disclaimer

Display of any trademarks, tradenames, logos and other subject matters of intellectual property belong to their respective intellectual property owners. Display of such IP along with the related product information does not imply BankBazaar's partnership with the owner of the Intellectual Property or issuer/manufacturer of such products.

FAQs on Loan Approval Process on CIBIL Scores

- What CIBIL scores are eligible for loan?

CIBIL scores between 720 and 750 are eligible for loan.

- How much time does it take for a loan to appear in CIBIL?

In general, credit institutions provide information to CIBIL in a 30- to 45-day period, so if you acquire your CIBIL Report within 45 days of your most recent payment of dues, it might not be updated. This causes your CIBIL Report to indicate an incorrect current balance or amount owing.

- Can I get a loan with a credit score of 650?

Yes, a credit score above 600 is considered a good score. Hence, you can get a loan with a credit score of 650.

- For how long does the CIBIL hold a credit report?

The CIBIL holds the credit report for a period of 7 years.

- Can I buy CIBIL scores?

No, you cannot purchase CIBIL score anywhere.

CIBIL Score Requirements for Loans

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.